Art is beautiful. Art is meaningful. Art can also be a very smart investment (Klimt). Many people only think of stocks or real estate when they think of investing. But the world of fine art is an asset class all its own.

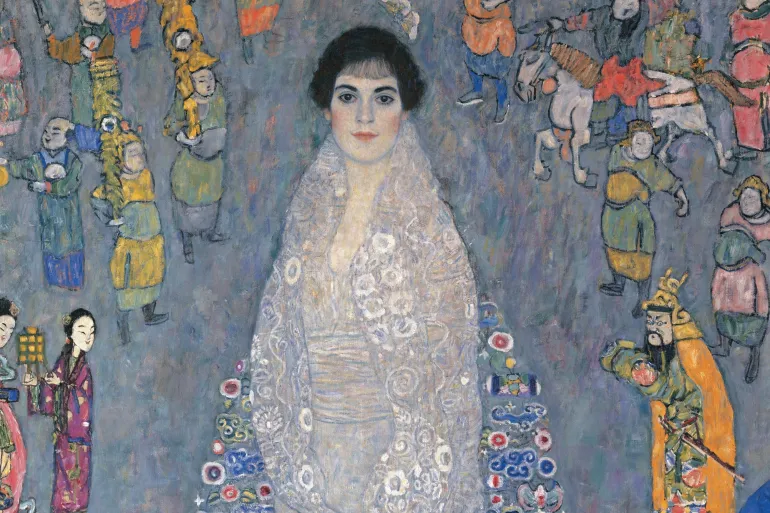

A huge event showed the power of art investment. It was the sale of Gustav Klimt’s Dame mit Fächer (Lady with a Fan). This painting sold for over $108 million in 2023. This price broke all records for a piece of art sold in Europe.

This massive sale gives clear lessons. It shows how the rich invest in art. It shows what makes a painting worth so much money. This article will teach you five simple lessons from the Klimt sale. You can use these lessons to start your own art investment journey.

Focus on Blue-Chip Artists Klimt

The first and most important lesson is to buy work from blue-chip artists.

- What is Blue-Chip? This term comes from the stock market. In art, a blue-chip artist is a master who is famous all over the world. They have died. Their history is complete. Their work is rare. Think of names like Picasso, Monet, Warhol, and Klimt.

- Why Klimt is Blue-Chip: Gustav Klimt is one of the most famous Austrian artists. He died in 1918. He had a unique style. His work is instantly recognizable. Very few of his paintings are available for sale. This rarity makes every single piece extremely valuable.

- The Investment: Buying blue-chip artists is safer than buying new artists. The value of their work does not go down easily. It is a slow, steady investment that grows over many decades.

The high price of the Dame mit Fächer sale was guaranteed because the painting was by Klimt. You must look for these proven names if you want to invest in art.

Rarity and Provenance are Key Klimt

Why did this one Klimt painting sell for so much? Because of rarity and provenance. These two words are vital in the art valuation process.

- Rarity: This painting was the last portrait Klimt ever painted. He died before it was finished. It is one of the very few Klimt paintings left in private hands. Rarity is simple: the fewer there are, the more expensive they are.

- Provenance: This means the history of ownership. The Klimt painting had an excellent provenance. It was owned by famous art families. It was never lost or questioned. This clear, clean history adds huge value to the art. No one can ever question if the painting is real.

You must always ask two questions when you look at a piece of art: How many of these exist? Who has owned it before? Clean provenance gives confidence to the buyers.

Art as an Asset Class (It is Slow) Klimt

Investing in art is completely different from investing in stocks. Art is an asset class that moves very slowly.

- Stocks vs. Art: You can buy and sell a stock in seconds. But you must hold a piece of art for at least 10 to 20 years to see big gains. Art is a long-term investment.

- Hedge Against Inflation: Art often holds its value well when the value of money goes down (inflation). When everything else is shaky, rich collectors put their money into physical assets like a Klimt painting. This is called investment diversification.

- The Art Market Cycle: The value of art goes up and down with the rest of the world economy. The Klimt sale happened when the global art market was strong. You must understand the art market cycle before you buy or sell.

If you are looking for fast money, do not invest in art. It is a safe place to store large amounts of wealth over a long period.

How to Start Investing Small Klimt

Most people cannot afford a $108 million Klimt. But you can still invest in art by using new methods.

- Fractional Art Ownership: This is the biggest new trend. Companies now buy expensive masterpieces. They divide the art into thousands of small shares. You can buy one share for as little as $50. You become a part-owner of the expensive painting. This is called fractional art ownership.

- Investing in Prints: You can buy signed prints or limited edition works from famous living artists. This is much cheaper than buying an original painting. These prints are often a great way to start building a collection.

- Lower Risk: Fractional art ownership allows you to put a small amount of money into many different pieces. This gives you better investment diversification and lowers your overall risk.

You do not need to be rich to start. You need to be smart and start small.

The Market Bubble and Risks

The high price of the Dame mit Fächer sale also shows a major risk: the art market bubble.

- What is a Bubble? A bubble is when prices go so high that they lose touch with reality. The top end of the art market often has too much money chasing too few paintings. This pushes prices to extreme levels, like $108 million.

- The Risk: If the world economy suddenly drops, these top prices could fall fast. The whole market could correct itself. This is the risk of the art market bubble.

- Be Patient: You must never buy art because of fear or excitement. Do your research. Buy because you believe the art is fundamentally important and will last over time.

The final lesson from the Klimt sale is to be careful. The rewards are huge, but the price you pay must be smart.

Dame mit Fäche

The Klimt sale of the Dame mit Fächer for $108 million gives clear steps on how to invest in art.

- Buy from blue-chip artists like Klimt.

- Focus on pieces with strong provenance and high rarity.

- Understand that art is a slow-moving asset class for long-term investment diversification.

You can start by using fractional art ownership or buying quality prints. The art market is complex, but with patience and the right focus, it can be a beautiful and powerful way to build wealth.

Read More Articles Click Here. Read Previous Article Click Here.